After a two-month lockdown due to COVID-19, Shanghai reopened on June 1, 2022. The full lockdown has brought Shanghai to a standstill and contributed to a sharp slowdown in China’s economic activity. While, such harsh experiences are over, but the longer-term business impact of Shanghai’s lockdown is profound and cannot be erased overnight.

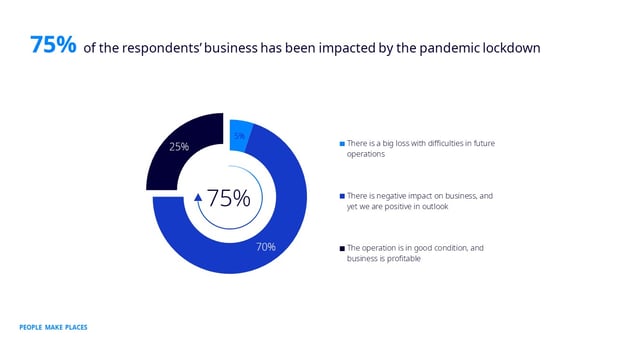

According to ISS China’s recent ‘Back to the Workplace’ survey*, 75% of respondents’ business has been impacted by Shanghai’s city-wide lockdown; 57% of respondents have taken some aggressive countermeasures. To support businesses recovering from the lockdown, the Shanghai government has released an action plan to aid business recovery as well.

In the post-Covid era, flexible working model is seen as a strategy to deal with long-term uncertainty over the city’s return to normalcy; It is also seen that the trend of strengthening integrated facility management services and enhancing workplace experience is prominent.

*About the ‘Back to the Workplace’ Survey

Shanghai has started full-scale resumption of work and production since June. As a leading company in facility management and workplace experience, ISS China has conducted a survey to learn more about the lockdown impact, return challenges, and facility management needs of various industries.

The survey is mainly designed for Shanghai’s situation. Facility management, CRE, HR, admin, procurement and other professionals were surveyed. Gathering insights from more than 100 companies of various industries (80% are medium or large companies), ISS expects to get a snapshot of the new normal in a post-pandemic future.

Lockdown Impact

75% of respondents’ business has been impacted; most respondents have taken countermeasures of reducing departmental budgets

It is seen that the pandemic has brought irreversible changes to the way businesses operate over the past three years globally. The harsh lockdown of Shanghai from March to June this year has brought varying degrees of negative impacts on the overall market since Shanghai is the most important financial, R&D, manufacturing, and supply chain centre in China.

According to ISS China’s ‘Back to Normal’ Survey, 75% of respondents’ business has been impacted by the city-wide lockdown and only 25% of respondents still maintained a profitable condition. On the positive side, most of the companies operating in Shanghai are still optimistic about the future outlook. In terms of the organization size, the larger the organization is, the more stable the business is.

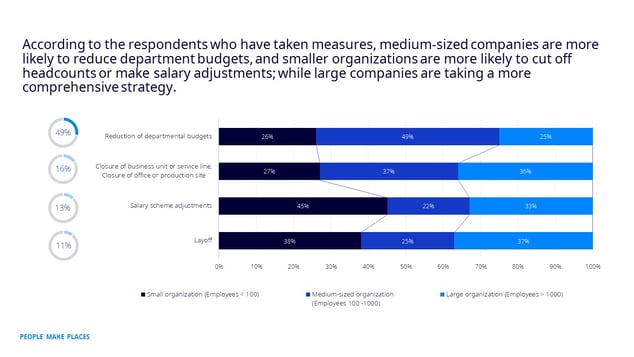

57% of respondents whose business were affected by the uncertainty of lockdown have taken some aggressive countermeasures, including reduction of departmental budgets; closure of subsidiaries, business unit, service line or workplace; salary scheme adjustments, and even layoff. Among which, 49% have taken the simplest and least impactful action: reducing departmental budgets.

In terms of the organization size, medium-sized companies are more likely to reduce departmental budgets, and smaller organizations are more likely to cut off headcounts or make salary adjustments, while large companies are taking a more comprehensive strategy.

The lockdown has had significant influence on business operation, especially small-sized enterprises. At the end of May, Shanghai has introduced a package of supporting policies for resumption of work. For industries such as manufacturing, scientific research, technology services, and small enterprises, Shanghai authorities will provide tax rebates, rent credits and other measures to help over difficulties. In terms of stabilizing foreign investment and foreign cooperation, Shanghai also actively supports foreign companies to resume operation, especially showing a strong support to those MNCs who’s regional headquarters are in Shanghai.

Challenges and Measure

66% of respondents consider hybrid flexible working model, but large and small organizations vary in their views

At this moment, Shanghai’s business has fully resumed work with majority of employees back to their positions.

In the past few months, companies have adopted working from home model due to the lockdown. When employees no longer gather in the office, corporation structure and culture have also been somewhat affected. Therefore, during the lockdown, it is noted that companies have organized an average of 3 initiatives to increase employee engagement and sense of belonging.

Each organization has held at least one online event including team building, webinar, online townhall, etc to boost employee engagement. Lockdown has also made people more concerned about health issue, thus 86% of organizations have organized online activities around employees’ physical and mental health, such as online sports training and mental consulting. Moreover, 66% of organizations have distributed necessities and care kits to employees.

When a company is faced with resumption, management team and employees have different concerns. The management believes that the biggest challenge comes from the uncertainty of the business effected by the Covid again. While, employees expect to a safe and healthy working environment, with higher demands for cleanliness and health. Employees also want more flexible choices in commuting time. Therefore, companies need to make corresponding actions to meet the expectations of employees.

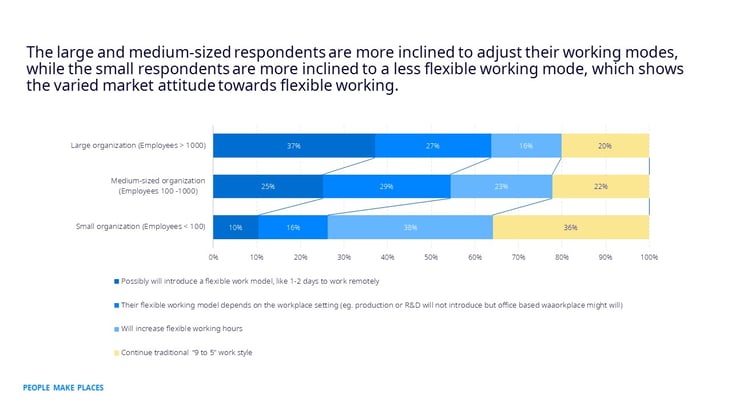

After getting back to normal, organizations have taken or plan to take an average of 2-3 measures to deal with the changes of workplace and employee mindset, including consider flexible working model, establish a contingent plan and schedule regular HSE workshops. Notably, flexible working model is listed as a long-term strategy for 66% organizations to deal with future uncertainties.

Flexible working model, as surveyed, includes the following three trails: introducing remote working for 1-2 days a week, adjusting working model according to their workplace setting, and increasing flexible working hours. The large and medium-sized companies are more likely to adjust their working modes, while the small respondents are more willing to stay in the office, which shows the varied market attitude towards flexible working.

While market acceptance and specific measures are varied, one thing for sure is organizations are giving employees greater freedom for work.

Demand of Facility Management Outsourcing

40% organizations prefer an integrated on-site service team; improving workplace experience becomes one of the top outsourcing drivers

The closure and reopening of workplaces, and the changing mindsets of employees and management are directly or indirectly driving changes in workplace and facility management needs.

As to outsourcing budget, 26% of respondents believe that they will increase their facility management budget considering post-covid risks although their overall business is affected. Noteworthy, 20% of respondents are considering reformulating their outsourcing strategy.

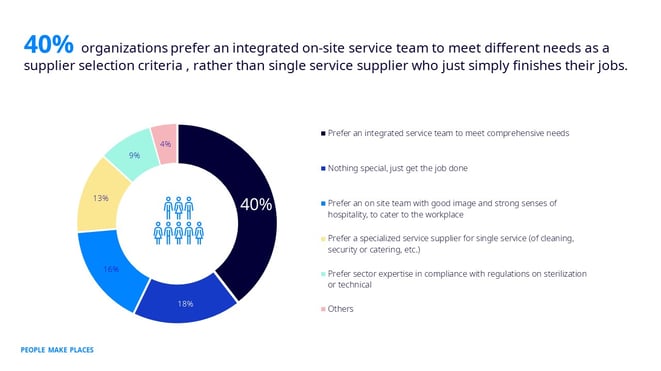

40% of organizations prefer an integrated on-site service team to meet different needs as a supplier selection criterion, rather than single service supplier who just simply finishes their jobs. Despite the general trend, each industry has its featured demand. Taking financial service industry as an example, they prefer an on-site team with good image and strong senses of hospitality, to cater to their workplaces. While life sciences industry prefers sector expertise in compliance with regulations on sterilization or technical.

In general, improving operational efficiency, reducing costs and workload, and integrating external resources are the top three drivers for facility management outsourcing. The top five drivers also include improving workplace experience and focusing on core business.

It is worth mentioning that in these five drivers, improving working experience has made the top among other traditional outsourcing reasons. This also indicates that currently facility management outsourcing is not just from a cost perspective, but also to create an environment where employees can thrive and perform, aiming to attract more talents, create better cooperation culture and enhance sense of belonging.

Returning to a new normal

In post-Covid period, companies are more likely to invest in their workplace offerings, including facilities, environment and experience. RE and FM professionals laid out three main reasons for their increased investment of workplace: to enable innovation and collaboration; to attract people to the office, and to enhance sense of belonging.

As of now, most organizations in Shanghai have fully resumed work. Due to the business impact from the severe lockdown, companies are rethinking the topic of the workplace, and welcoming a new normal, either proactively or reactively.

About ISS China

Founded in Denmark in 1901, ISS is a leading workplace experience and facility management company. ISS has been developing in China for more than 15 years. In China, nearly 10,000 ISS placemakers are located in more than 80 cities across the country, providing comprehensive services including cleaning, security, engineering, workplace experience, catering and other services for financial services, technology, manufacturing, education, life science, healthcare and other industries. ISS provides placemaking solutions that contribute to better business performance, better workplace experience and makes life easier, more productive and enjoyable. For more information, visit ISS China.